[ad_1]

The latest sell-off in Chinese language shares has pushed Baidu (BIDU) and Alibaba (BABA) close to their money values, offering a superb entry level for worth traders with a long-term horizon. Analysts see the shares of the 2 corporations buying and selling 75.37% and 40.18% increased, 12 months from now.

The world “disaster” is written with two characters in Chinese language: one character which means “hazard” and one other which means “alternative.” The latest crash in China’s listed shares presents each a menace and a possibility for traders. (See Alibaba inventory charts on TipRanks)

The menace is to “catch a falling knife,” shopping for shares of Chinese language corporations which have been justifiably offered off—corporations with shaky fundamentals. The chance is to purchase shares of Chinese language corporations which have unjustifiably been offered off—corporations with sound fundamentals that commerce at discount costs, like Baidu, Inc. and Alibaba Group Holding Restricted. They each have sturdy financial fundamentals and commerce close to money worth, which means that traders pay little or no to amass a superb enterprise. (See Baidu inventory charts on TipRanks)

Baidu’s present Complete Money per Share is $482.43. Its Complete Debt is 82.68B, and its present share value is$164.26.

Alibaba’s present Complete Money per Share is $177.75. The corporate’s Complete Debt is $181.24B, and its present share value is $196.39.

Baidu Inc.

China is the world’s largest web market, and Baidu is the nation’s largest web search engine, with 94.5% market share, in accordance with Statist.com. That’s why it’s known as the “Google of China.” It additionally owns Baidu Feed, which offers customers with customized searches, plus the Haokan quick video streaming app, and the Quanmin flash video app, for creating and sharing quick movies.

In the meantime, Baidu is catching up with its American counterpart Google (GOOGL) in innovation and has made it to MIT Know-how Evaluation’s annual listings of the 50 most revolutionary corporations.

Baidu’s dominant place in web search and streaming video providers, together with its revolutionary drive, have helped the corporate accumulate $482.43 per share, which exceeds present market value, even after the $82 billion are factored in.

Merely put, Mr. Market—to make use of Benjamin Graham’s expression–is too pessimistic on Baidu shares, leaving money on the desk.

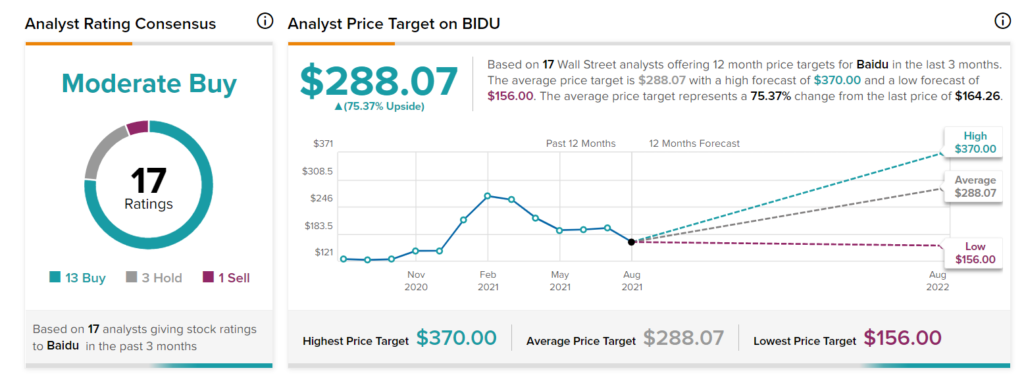

The 17 Wall Avenue analysts following Baidu see its shares buying and selling at a mean value of $288.07 12 months from now, with a excessive forecast of $370.00 and a low forecast of $156.00. The typical Baidu value goal represents a 75.37% change from the final value of $164.26.

Alibaba Group

Alibaba Group Holding Restricted is one other Chinese language firm driving the world’s largest web market. It offers expertise infrastructure and advertising and marketing attain to retailers, manufacturers, retailers, and different companies to have interaction with their customers and clients at dwelling and overseas. That is why it’s known as the “Amazon of China.” (AMZN)

Alibaba enjoys a number of benefits, corresponding to economies of scale, scope, and networking in a winner-take-all sport. The corporate has been rising by leaps and bounds.

Alibaba’s sturdy market place and quick progress have helped the corporate accumulate near $178 {dollars} per share in money. That’s very near its market value, even after the $181 billion debt is factored in.

The 25 Wall Avenue analysts following Alibaba see its shares buying and selling at a mean value of $275.30, 12 months from now, with a excessive forecast of $336.00 and a low forecast of $190.00. The typical Alibaba value goal represents a 40.18% change from the final value of $196.39.

Abstract and Conclusions

The latest sell-off in Chinese language shares presents a superb alternative for worth traders to choose up shares of Chinese language web corporations with stable fundamentals buying and selling at discount costs, like Baidu and Alibaba. As well as, each corporations commerce close to their money per share, even after the debt is factored in, which means that traders can purchase the 2 corporations’ enterprise for subsequent to nothing.

Benjamin Graham would in all probability have taken an curiosity in each corporations, supplied, after all, that he could be ready to imagine the regulatory dangers related to Chinese language shares.

Disclosure: The creator owns shares of Baidu and Alibaba.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is vitally essential to do your individual evaluation earlier than making any funding.

[ad_2]

Source link