[ad_1]

Is the worldwide economic system steering towards a Bretton Woods for the digital-currency age?

Sunday marks the fiftieth anniversary of what has been described because the dropping of a “financial bombshell” on the world monetary system, when President Richard Nixon introduced that the U.S. greenback would not be pegged to gold

GC00,

successfully yanking America out of a global forex regime established by the Bretton Woods settlement.

The worldwide financial system was solid within the Nineteen Forties amid the battle in opposition to fascism and international financial instability. The first intention of the Bretton Woods settlement was to create a forex system much less inflexible than the gold customary whereas offering monetary stability. As a part of the trouble, the convention laid the foundations for the Worldwide Financial Fund and the World Financial institution.

Now, 5 many years later, the financial regime within the wake of the dissolution of the Bretton Woods system on Aug. 15, 1971 isn’t that a lot completely different. The U.S. greenback nonetheless serves because the reserve forex of the world, however in an period of bitcoin

BTCUSD,

and blockchain-backed currencies, the rise of stablecoins pegged to fiat currencies, and central financial institution digital currencies, or CBDCs, a brand new international regime is rising.

“It’s very clear that there’s a want for a reckoning of the challenges of the present monetary system,” Sheila Warren, the World Financial Discussion board’s head of blockchain, digital forex and information coverage, instructed MarketWatch in a Friday cellphone interview.

Warren mentioned that “the current [monetary] scenario isn’t working for sufficient folks successfully,” and underscored the financial gaps between international locations as one key cause a sweeping digital-era Bretton Woods might be efficient.

“The case for a global forex is as sturdy in the present day because it was then, however stays tough to implement,” wrote Ousmène Jacques Mandeng, director of advisory boutique Economics Advisory Ltd, in a visitor column within the Monetary Instances printed Monday (paywall). Mandeng described the depegging of gold from the greenback in 1971 as “a financial bombshell.”

There are just a few similarities between the interval of Nixon and 2021. Inflation picked up steam within the Nineteen Sixties and reached almost 6% in 1970, and world greenback reserves rose sharply. Inflation was working at round 5.4% over the previous 12 months from 1.4% in 2020, based on the Bureau of Labor Statistics.

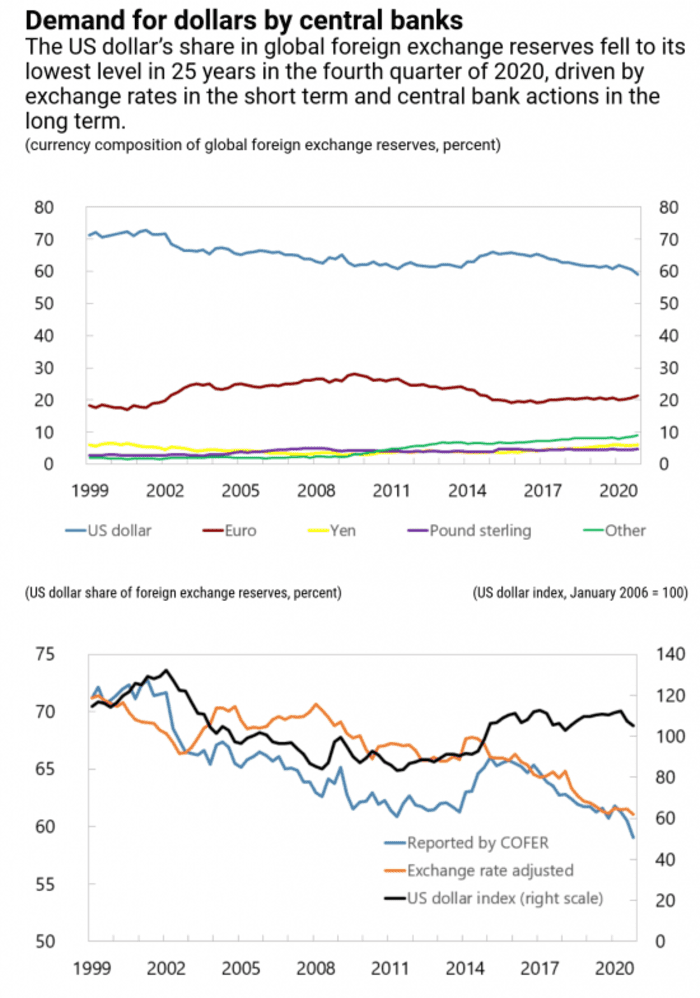

Nevertheless, the share of U.S. {dollars} held in international overseas trade reserves is across the lowest ranges in 25 years, through the fourth quarter of 2020, essentially the most not too long ago accessible information, based on the IMF’s Forex Composition of Official Overseas Change Reserves survey.

IMF

In the meantime, the availability of secure cash, like Tether

USDTUSD,

and Circle-backed USDC digital currencies normally underpinned by a fiat forex or another conventional asset to maintain values mounted, has climbed by 900% to over $100 billion from a 12 months in the past, the Block reported in late Might.

Cryptocurrencies like bitcoin haven’t change into extensively used as a way of cost, partially as a result of their values are unstable relative to the U.S. greenback

DXY,

or different government-backed currencies.

Nevertheless, crypto bulls see stablecoins as important for increasing the usage of digital currencies for day by day purchases. And advocates of a so-called central financial institution digital forex have argued {that a} CBDC might perform equally to a stablecoin, however with lowered danger and the total religion of the federal government.

A motion towards a digital regime might already be below approach.

U.S. Treasury Secretary Janet Yellen not too long ago convened a gathering of regulators, together with U.S. Securities and Change Fee head Gary Gensler, to debate stablecoins, in mild of the fast proliferation of the digital belongings and issues concerning the underpinnings of the digital-ledger pegged forex.

Critics of stablecoins say stablecoins pose important dangers to monetary stability, particularly after it was revealed that a few of these fiat-linked tokens aren’t 100% backed by precise U.S. {dollars} or different liquid belongings, and as an alternative are secured by a mix of riskier belongings that would buckle throughout a market disaster.

Kenneth Rogoff, a professor of economics and public coverage at Harvard College, instructed MarketWatch in a Friday cellphone interview that he can perceive why stablecoin provide, specifically, has exploded.

“A variety of it’s the unease, not simply with the Chinese language however the Europeans, with the U.S. controlling the rails of the worldwide [monetary] system as a result of the greenback is so dominant,” Rogoff mentioned.

Rogoff mentioned that stablecoins supply an fascinating potential use-case for governments completely different from CBDCs but in addition presents challenges for financial coverage makers. “I feel regulators wish to be cautious to not use regulation as a solution to shield the incumbents [like bricks-and-mortar banks], particularly if there may be another method.”

The previous chief economist of the IMF from 2001 to 2003 mentioned that he thinks that there’s nonetheless quite a bit to do earlier than any CBDC meets the necessities to be used by central banks. He mentioned that CBDCs must have the identical stage of transparency, pace and ease of use that the U.S. Federal Reserve at the moment enjoys with the present system.

“The endgame is that this: How can we regulate [digital currencies] in order that the central financial institution feels comfy that they are going to be your lender of final resort?” Rogoff mentioned.

“The sport-changer can be if CBDCs had been interoperable,” writes Barry Eichengreen, professor of economics on the College of California, Berkeley, and a former senior coverage adviser on the Worldwide Financial Fund, in a column for Mission Syndicate printed Tuesday.

WEF’s Warren mentioned that an “terrible lot of coordination” can be wanted to attain a Bretton Woods-style accord for the digital age however seems like the dearth of a deliberate concerted international effort thus far amid the lethal pandemic has been one of many “best tragedies of her era.”

In 2008, the primary digital forex, bitcoin, was minted by an individual or individuals, figuring out themselves as Satoshi Nakamoto. SEC Chairman Gensler earlier this month on the Aspen Safety Discussion board mentioned that “at its core, Nakamoto was making an attempt to create a personal type of cash with no central middleman, similar to a central financial institution or industrial banks.” however “no single crypto asset, although, broadly fulfills all of the capabilities of cash.”

For his half, Rogoff views crypto extra broadly as not an answer on the lookout for an issue however merely put: “an issue.”

“Ransomware, tax evasion, crime: It’s the Wild West,” he mentioned of digital belongings.

What’s on deck subsequent week?

After the S&P 500 index

SPX,

and the Dow Jones Industrial Common

DJIA,

on Friday booked 4 straight document closes for the primary time since 2017, traders can be targeted primarily on U.S. July retail gross sales information at 8:30 a.m. ET Tuesday and the minutes from the Federal Open Market Committee’s final assembly due at 2 p.m. on Wednesday to glean additional clues concerning the well being of the economic system and the central financial institution’s financial coverage plans.

Wednesday additionally brings studies on housing begins and constructing permits at 8:30 a.m. that possible can be adopted for insights on the house market, which is exhibiting indicators of cooling.

Traders may watch a studying of producing within the New York state space for August, Empire State manufacturing index at 8:30 a.m. on Monday, the same report for the Fed’s Philadelphia area on Thursday, in addition to the standard weekly jobless profit claims report at 8:30 a.m.

Subsequent week, markets are retail heavy, with giants like Walmart Inc.

WMT,

Residence Depot Inc.

HD,

set to report on Tuesday. Goal Corp., home-improvement firm Lowe’s Cos.

LOW,

and TJ Maxx guardian TJX Cos.

TJX,

set to report on Wednesday. Semiconductor firm Nvidia NVDA additionally studies Wednesday.

Coach guardian Tapestry

TPR,

Estee Lauder Cos.

EL,

Ross Shops

ROST,

and Macy’s Inc.

M,

report on Thursday.

[ad_2]

Source link