[ad_1]

Alternate traded funds updates

Signal as much as myFT Each day Digest to be the primary to find out about Alternate traded funds information.

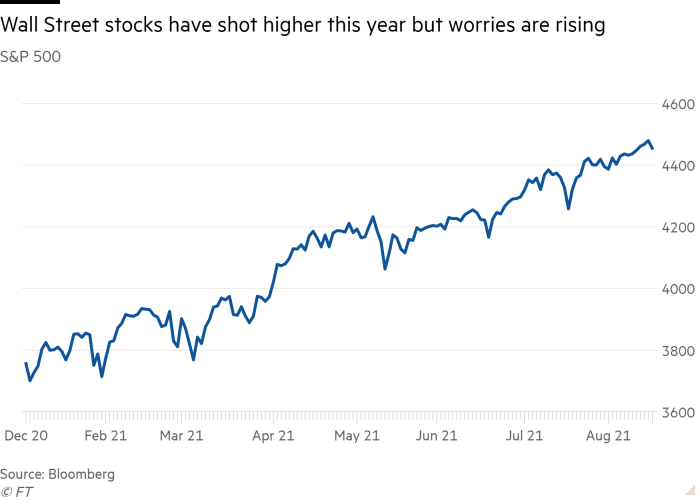

Billions of {dollars} have flowed into “defensive” alternate traded funds in current weeks, highlighting the jitters arising in some corners of Wall Road after US shares have set a sequence of report peaks.

The resurgence in coronavirus infections in some US states, proof of rising inflationary pressures and issues that the Federal Reserve will quickly begin to cut back its huge asset buying scheme have already prompted some traders to undertake a extra cautious stance.

US shares got here below promoting stress on Tuesday with the S&P 500 pulling again by about 0.7 per cent in morning dealings. The autumn got here after a spherical of disappointing information on US retail gross sales for July. Buyers have been weighing whether or not the speedy unfold of coronavirus and decrease ranges of presidency stimulus funds will start affecting consumption, which accounts for about 70 per cent of America’s financial output.

The S&P 500 nonetheless stays up a few fifth for the yr thus far, having doubled from the lows hit throughout the market tumult of March 2020. On the similar time, the index has gone virtually 200 buying and selling days and not using a 5 per cent pullback, based on Financial institution of America, one of many longest such streaks previously half-century — a tranquil grind greater that has added gas to a shift below the market’s floor.

ETFs linked to US defensive sectors that are inclined to carry out effectively in more durable environments — healthcare, client staples and utilities — collectively attracted internet inflows of just about $5bn in July after registering mixed outflows of $3.6bn within the first half of 2021, based on State Road World Advisors.

“The inflows in July went primarily into defensive sectors. That has continued into August with healthcare and utilities sector ETFs each taking one other $1bn every in inflows thus far this month,” stated Matthew Bartolini, head of SPDR Americas analysis at State Road.

In distinction, ETFs linked to extra economically delicate US sectors — financials, supplies, industrials, client discretionary, vitality and actual property — all registered outflows in July that totalled $7.2bn. These six cyclical sectors had collectively gathered $57bn within the first half of the yr.

Bartolini stated proof of a “bullish however nervous” temper amongst traders was additionally evident in flows for good beta ETFs, which intention to take advantage of long-term mispricings. ETFs that target so-called high quality shares with dependable earnings grabbed inflows of $21bn in July after posting outflows of $3.8bn within the first half of 2021.

Momentum ETFs, which purchase equities with constructive current value tendencies, registered outflows of $856m in July, virtually wiping out the inflows of $1.1bn gathered over the primary six months of this yr. Worth ETFs, which purchase underpriced shares that are inclined to do effectively in intervals of strengthening financial progress, notched outflows of $1.4bn final month after taking in $12.8bn within the first half.

Scott Chronert, an analyst at Citigroup in New York, stated the financial restoration commerce which ETF traders favoured within the first half of the yr “appears to have misplaced its lustre” with a “extra risk-off bias” evident in ETF flows in July.

US fairness ETFs have registered inflows of about $250bn thus far this yr, offering gas for the S&P 500’s report run. With the primary US fairness benchmark hitting a recent all-time excessive this month, extra traders are questioning simply how a lot additional the rally can run.

“Shoppers have felt there’s nowhere else to go however into equities as a result of bond yields are so low. However we’re recommending that purchasers transfer to a extra defensive place as a result of returns from equities are more likely to be decrease and extra unstable within the second half of the yr,” stated David Jones, a strategist at BofA in New York.

A BofA survey of traders with $702bn in belongings below administration highlights these issues: expectations that the world financial system will proceed bettering slumped in August to the bottom degree since April 2020.

Earnings for the second quarter, which exceeded analysts’ expectations, had been reported by 391 constituents of the S&P 500 by August 11, based on Citigroup. Simply 55 S&P 500 firms have reported earnings disappointments thus far for the second quarter.

Tobias Levkovich, Citigroup’s chief US fairness strategist, stated US firms had delivered “shockingly good” outcomes. Nonetheless, traders are rising extra anxious about whether or not US teams can meet the excessive bar set within the second quarter. The BofA fund supervisor survey indicated optimism over company earnings had eased, whereas traders now anticipated revenue margins to say no — one thing they’d not forecast since final summer season.

“Few [investors] suppose there’s wherever to go along with new cash apart from to equities at this juncture. [But] we suspect that the mixture of upper US taxes, doubtlessly extra persistent inflation, Fed taper speak and potential margin compression all assist the likelihood of a correction,” stated Levkovich.

[ad_2]

Source link