[ad_1]

The eurozone’s newest financial progress figures are just a little higher than anticipated. This group of 19 EU nations grew 2.2% within the second quarter of 2021 in comparison with the primary quarter, partly due to first rate performances from Spain and Italy.

However whereas the US and Chinese language economies are each now larger than their 2019 peaks, the eurozone is 3% off that achievement. And while you look extra broadly on the state of the eurozone, this seems to be solely the tip of the iceberg.

Covid-19 nonetheless overshadows all the things around the globe, however international locations are prone to recuperate at completely different speeds as soon as we get again to some kind of normality. This may rely upon the construction of their economies, the effectiveness of their restoration insurance policies, and the way they cope with excessive sovereign money owed and a foreseeable mixture of weakish progress and inflation. However for a number of causes, the eurozone significantly worries me.

Ghosts of the previous

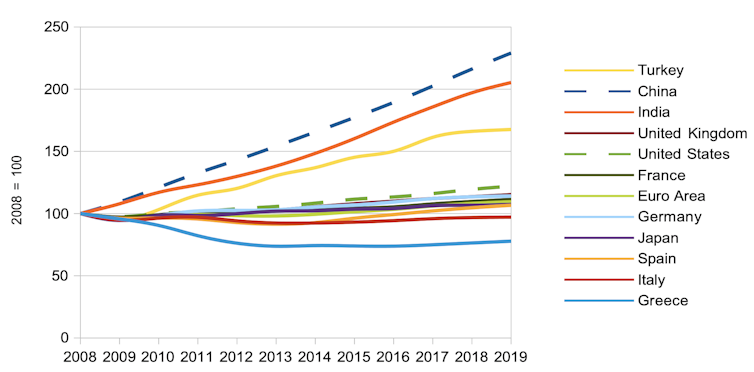

The primary is the eurozone’s bleak efficiency because the international monetary disaster of 2007-09. It took six years to regain its 2008 GDP degree, and a few members did even worse: Spain and Portugal took virtually a decade, and Italy and Greece have but to get there.

When Covid broke out, the eurozone progress price remained nicely under its long-term trajectory. It was behind the US and UK, each of whom had been hit tougher by the worldwide monetary disaster, and even worse in comparison with the main rising economies. Neither was this a one-off. Wanting on the previous 5 recessions, the eurozone nations have been successively slower to recuperate from every one.

GDP by nation since 2008

Muhammad Ali Nasir

Since 2008, the ECB has tried quite a few measures to enhance progress. Like most main powers, it has completed loads of quantitative easing (QE), which entails creating cash to purchase sovereign bonds and different monetary property. It has sought to prop up its retail banks in varied methods, whereas additionally pioneering destructive rates of interest and giving the markets extra ahead steering about financial coverage.

Famously in 2012, then ECB president Mario Draghi stated he would do “no matter it takes” to save lots of the euro. This ahead steering saved the euro steady, however the identical can’t be stated of progress.

Poor coverage and low ammunition

Coverage errors are partly in charge for this. With the advantage of hindsight, the eurozone went into the worldwide monetary disaster with lending charges on the low facet, so had much less room to chop than different areas. It was additionally extra reluctant than central banks just like the Financial institution of England and US Federal Reserve to start out QE, preferring to give attention to curbing inflation and making the euro “stabil wie die mark” (steady just like the German mark). The ECB didn’t unveil a QE programme till 2015.

Nations with the capability to spend to stimulate their economies, equivalent to Germany, France and the Netherlands, additionally did too little. Spain’s stimulus was poorly designed, whereas Italy was extra curious about balancing its books on the time. Too quickly after the disaster struck, austerity then turned the precedence for the entire eurozone.

A associated downside has been private and non-private funding. In middle-income EU areas, funding charges fell by about 14% between 2002 and 2018. In thrifty Germany, private and non-private fastened investments declined as a proportion of GDP for many years, regardless of an enormous surplus in public spending.

Earlier than Covid hit, EU infrastructure funding was at a 15-year low, with the best declines in areas that had been already lagging. Initiatives meant to assist, such because the European Financial Restoration Plan of 2008 and the European Fee Funding Plan in 2014, had been too little.

The general consequence was that weak point: Germany and the eurozone as an entire had been displaying 0% progress on the time of the Covid outbreak, whereas Austria, France and Italy had been all contracting barely. In response, the ECB had lower its foremost rate of interest by 0.1 proportion factors to -0.5% in September 2019, and restarted month-to-month QE to the tune of €20 billion (£17 billion) from November 1 of that yr – the date Christine Lagarde turned ECB president.

The eurozone economic system was subsequently needing life help even earlier than the pandemic – certainly, lots of the ECB’s different unconventional help measures had been in place all through. Tellingly, the ECB’s solely new measure throughout the pandemic has been a brand new type of cheaper refinancing for banks. It raises the prospect of the ECB operating out of the ammunition wanted to maintain stimulating the eurozone’s sickly economic system.

Self-discipline über alles

Lastly, some eurozone members are obsessive about the EU’s fiscal guidelines round low nationwide debt and low deficits. The Monetary Instances might have reported in March 2020 that “Germany tears up fiscal rule guide to counter coronavirus pandemic”, however there are already calls by influential figures equivalent to Bundestag president Wolfgang Schäuble to return to fiscal self-discipline.

A rush to austerity 2.0 is a luxurious that the EU can not afford. To cite one thing usually attributed to Albert Einstein, madness is doing the identical factor time and again and anticipating completely different outcomes.

For various outcomes, the ECB ought to stand its floor on financial easing and, just like the Fed, keep away from giving in to inflationary pressures which might be prone to be quick time period by elevating charges or paring again QE.

In the meantime, the fiscal guidelines want loosening to correspond to financial realities. The temptation have to be averted to throw the nations within the peripheries beneath the austerity bus once more, one of many foremost causes of the eurozone disaster of the early 2010s.

Surplus nations, significantly Germany, ought to revive spending in infrastructure, training and know-how. The EU’s €750 billion Subsequent Era EU funding plan will belatedly kick in later this yr, however identical to the 2 earlier EU restoration packages, will most likely not be sufficient by itself.

With an unimpressive monitor report on restoration, inherently weak economies, an obsession with fiscal guidelines and the prospect of the ECB operating out of ammunition, the choice could possibly be a second misplaced decade. What that might do to the eurozone and the EU, it could be higher to not discover out.![]()

Muhammad Ali Nasir, Affiliate Professor in Economics and Finance, College of Huddersfield

This text is republished from The Dialog beneath a Artistic Commons license. Learn the unique article.

[ad_2]

Source link