[ad_1]

Each investor – from essentially the most skilled legends of Wall Avenue to essentially the most newbie of retail merchants – retains a detailed eye in the marketplace, on the lookout for some signal or sign to point simply the fitting trades.

Following the company insiders is one approach to discover a bonus. These are the corporate officers whose positions put them ‘in-the-know’ on their firms’ internal workings.

That data provides these bigwigs an inside monitor in the case of buying and selling their very own shares – and to maintain the buying and selling flooring honest, governmental regulators require insiders to publish their trades in a well timed method, as a manner of avoiding their having an undue benefit.

Buyers can comply with these trades on TipRanks, utilizing the Insiders’ Scorching Shares instrument. We’ve finished a little bit of looking to get the story began, and located two shares which are each Sturdy Buys, in line with the analyst neighborhood, and are additionally displaying million-dollar insider trades.

Power Switch (ET)

We’ll begin with a high-yield dividend inventory within the power midstream section. By any measure – market cap, measurement of community, quantity of product moved – Power Switch is without doubt one of the largest midstream firms working within the US. The corporate boasts one of many continent’s largest arrays of pipelines and different transport belongings, in a community operating from the Mid-Atlantic coast to the Nice Lakes into the Mississippi Valley and on all the way down to the corporate’s major space of operations, Texas-Oklahoma-Arkansas-Louisiana and alongside the Gulf Coast into Florida, together with offshore pipelines from Louisiana.

Power Switch has benefited from rising costs for oil and fuel, and the corporate’s 1Q22 income got here to $20.49 billion, the very best up to now two years, up 20.5% year-over-year, and the third quarter in a row to point out a sequential achieve. Earnings gave a blended story; the diluted EPS of 37 cents beat the 30-cent forecast however got here in far beneath the $1.21 recorded within the year-ago quarter.

This calendar yr additionally marks ET’s first yr working after finishing its acquisition of Allow Midstream. That transfer, price roughly $7.2 billion, was accomplished in December in a principally inventory transaction. A $10 million money cost was delivered to Allow’s normal accomplice.

For the reason that merger, Power Switch has had management of Allow’s pipeline community, which was folded into ET’s present community, bringing the overall to just about 120,000 miles.

Power Switch’s revenues and enlargement have additionally given the corporate confidence in elevating its frequent share dividend cost. In the latest declaration, for 2Q22, the cost was set at 20 cents per frequent share, up greater than 30% year-over-year, and the second quarter in a row to point out a rise. The 80-cent annualized cost yields a robust 7.7%.

Turning to the insider trades, we discover that the latest ‘informative purchase’ got here from Board of Administrators member Richard Brannon, who final week picked up 137,680 shares, paying a complete of $1.33 million.

Raymond James 5-star analyst Justin Jenkins can be impressed with this firm, and takes a bullish line when he writes: “We see this as a compelling alternative for entry into possession of one of many higher positioned MLPs to capitalize on the present setting, in our view. Working leverage within the type of potential merger synergies are solely accelerating after the ENBL acquisition and alongside increased commodity costs. With monetary dangers far lessened – and buyers possible extra snug with the near-term fundamentals — the main focus ought to shift to ET’s comparatively favorable positioning for 2022 and past.”

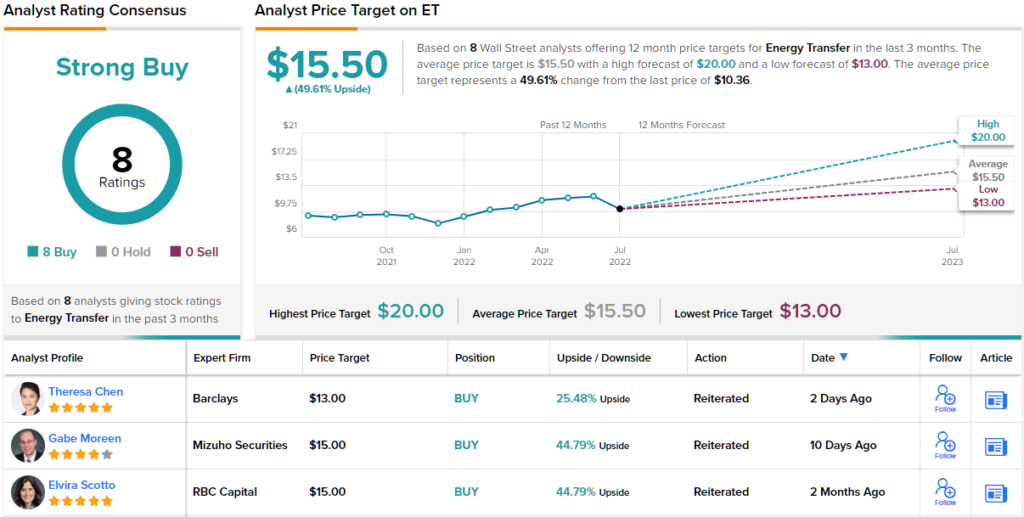

Bringing ideas into numbers, Jenkins provides ET shares a $15 value goal, indicating potential for ~45% upside this yr. Jenkins charges the inventory a Sturdy Purchase. (To observe Jenkins’ monitor report, click on right here)

Wall Avenue typically would appear to imagine that buyers can not go incorrect by getting in on ET, as proven by the 8 current constructive evaluations on the inventory. These give the inventory a unanimous Sturdy Purchase consensus ranking. The shares are promoting for $10.36 and their $15.50 common goal implies ~50% one-year upside. (See ET inventory forecast on TipRanks)

Gossamer Bio (GOSS)

Subsequent up, Gossamer Bio, is a scientific stage biopharmaceutical analysis agency, engaged on the invention, growth, and eventual commercialization of recent therapeutic brokers for the remedy of illness circumstances in immunology, irritation, and oncology. Gossamer at the moment has two scientific trials underway, a 3rd drug candidate within the late discovery levels, and a number of other extra discovery tracks simply getting began.

The corporate’s main drug candidate is GB002, or seralutinib. This drug is being examined as a remedy for pulmonary arterial hypertension, or hypertension within the arteries that take deoxygenated blood to the lungs. Seralutinib is the topic of the Section 2 TORREY research, through which affected person enrollment has not too long ago been accomplished. Prime line outcomes from this research are anticipated for launch in 4Q22.

The corporate’s second clinical-stage drug candidate is GB5121, an orally dosed penetrant BTK inhibitor below testing within the remedy of major CNS lymphoma. Gossamer is at the moment initiating a Section 1b/2 research of GB5121.

Lastly, essentially the most superior discovery-stage drug candidate, GB7208, is on the cusp of beginning scientific trials. That is one other orally dosed penetrant BTK inhibitor, and the corporate is making ready to check it as a remedy for neuroinflammatory ailments. Initiation of a Section 1 scientific trial is tentatively set for 1H23, pending pre-clinical outcomes and the information launch from the seralutinib research.

On the insider entrance, we discover that there have been a number of current buys from firm officers. Three of those have been within the $50K to $100K vary – however the fourth caught our consideration. Faheem Hasnain, President of Gossamer, picked up 138,696 shares of GOSS final week, paying $1 million.

Gossamer has its followers among the many analysts as effectively. Protecting this inventory for SVB, analyst Joseph Schwartz outlines a bullish view for Gossamer’s future.

“The upcoming PAH readout knowledgeable our selection of GOSS as a high choose for 2022 primarily based on our view that the occasion has a excessive chance of success as it’s partially de-risked by prior scientific information from seralutinib… Though there are numerous permitted therapies for PAH, excessive unmet want stays for therapies that may enhance outcomes and longevity in a extra tolerable, patient-friendly method. We imagine seralutinib’s inhaled route of administration will improve tolerability, and we’re notably inspired by administration’s commentary on Ph.2 retention/open-label extension (OLE) continuation charges,” Schwartz opined.

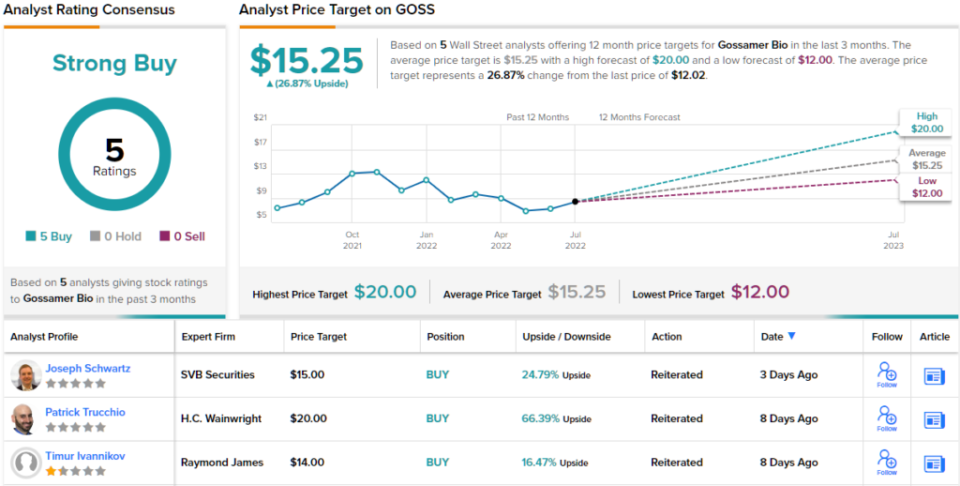

To this finish, Schwartz places an Outperform (i.e. Purchase) ranking on the inventory, and his $15 goal implies it has an upside of ~25% to stay up for. (To observe Schwartz’s monitor report, click on right here)

Total, Wall Avenue is mostly sanguine about Gossamer’s ahead path. With 5 Buys and no Holds or Sells, the phrase on the Avenue is that GOSS is a Sturdy Purchase. The shares are buying and selling for $12.02 and their $15.25 common goal suggests ~27% upside within the subsequent 12 months. (See Gossamer inventory forecast on TipRanks)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather vital to do your personal evaluation earlier than making any funding.

[ad_2]

Source link